In centrally-organized electricity spot markets, resources are scheduled and dispatched to meet anticipated demand plus a margin of operating reserves. When energy demand is met and operating reserves are maintained, the system is secure. At times, due either to unanticipated demand or resource outages, the system is in shortage and does not have resources available to meet both demand and reserves. In these instances, a marginal MW of supply not only meets the instantaneous energy demand, but also helps ensure system reliability by maintaining reserves.

When the system does not have adequate capacity available to meet both energy and reserves, the system operator deploys reserves to meet energy demand, allowing the system to be short of reserves. When this happens, the price of reserve products should reflect the value to the system of restoring marginal reserve capacity. The market can reflect this using an Operating Reserve Demand Curve (ORDC) that sets prices for reserve products based on the marginal reliability value of reserves at each level of shortage. The marginal reliability value of reserve capacity is:

VOLL * p(s),

where VOLL is the value of lost load, estimated based on the cost to consumers of involuntarily losing their supply of electricity, and p(s) is the probability of losing load at a reserve shortage of s MW.

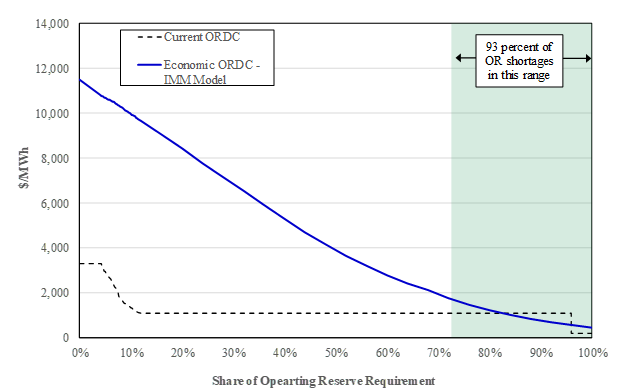

Because the probability of losing load increase when reserve shortages increase, the operating reserve demand curve reflects higher prices for reserves as the reserve shortage grows. The figure below shows an ORDC that we proposed for the Midcontinent Independent System Operator (MISO) where we proposed a VOLL-based Operating Reserve Demand Curve. This figure compares our proposal to the existing MISO ORDC.

Reserves shortage should also be reflected in energy prices because reserves are being deployed to serve energy. Every MW of energy imported to the market reduces the reserve shortage by one MW by allowing an internal generator to ramp down and provide reserves. Therefore, the energy price should also reflect the marginal value of reserves.

Well-designed shortage pricing sends efficient price signals in the short run and the long run. In the short run, shortage prices provide efficient compensation for flexible, fast-ramping resources and thereby provide incentives for resource owners to be available during shortage conditions. This will be increasingly important as more intermittent wind resources enter the market that must be balanced by flexible resources. These prices also send signals to suppliers in other markets to export energy to the region in shortage. In the long run, efficient shortage pricing provides incentives for participants to build more flexible, fast-ramping generating resources, and to make efficient maintenance and retirement decisions for existing resources to increase their flexibility.