Most electricity markets have requirements to maintain a minimum level of generating capacity to ensure that they can keep the lights on under nearly all conditions. Energy and operating reserve markets will typically not provide enough revenue to keep this quantity of generation in service, so capacity markets were developed to provide economic signals that would supplement the RTOs’ energy and ancillary services markets to inform long-term capacity decisions, including investment, retirement, and maintenance of resources. The revenue produced by the capacity markets provide the “missing money” necessary to satisfy the RTOs’ capacity requirements.

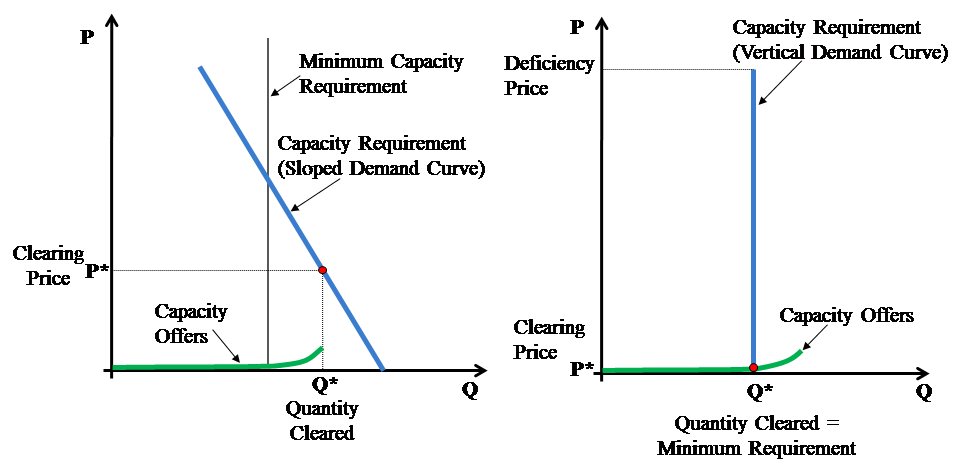

For these markets to do their job and perform efficiently, the demand for capacity by the RTO should reflect the value it provides (as with any product). The demand for capacity is ultimately a function of the reliability it provides to electricity consumers in MISO, which diminishes as the quantity of capacity rises. This suggests that the demand must be structured as a “sloped” demand curve for the market to produce reasonable outcomes. This is especially important in the capacity market because the costs of selling capacity are generally very low so the demand must set the price as shown below. When an RTO establishes a capacity demand that is a single amount (i.e., a “vertical demand curve”), the market will generally perform poorly and clear at close to zero as has been the case in the MISO capacity market.